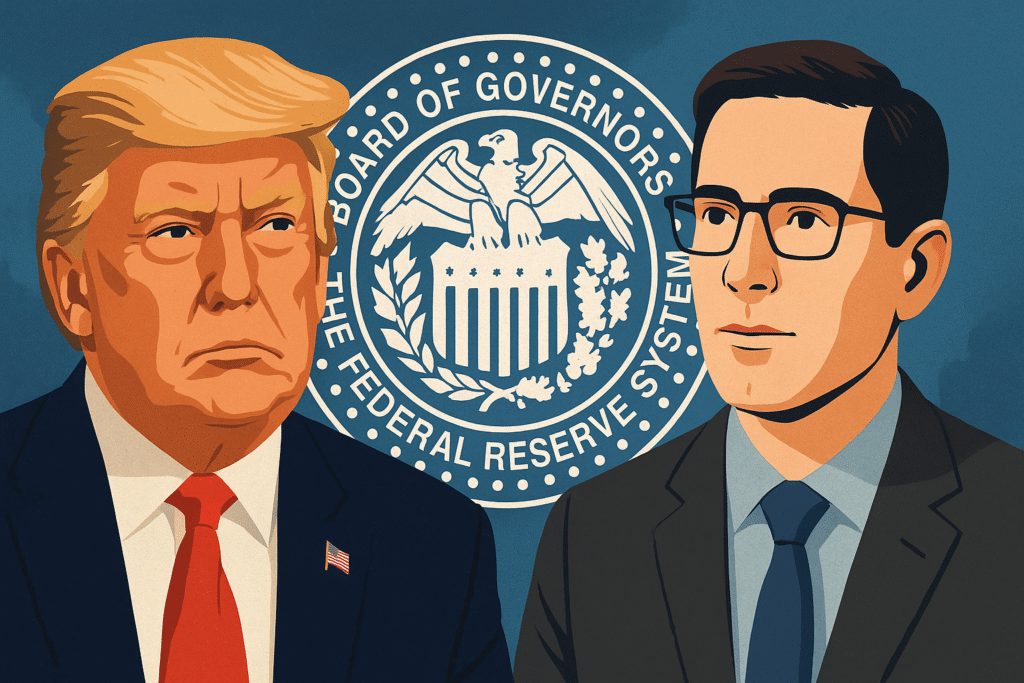

Former U.S. President Donald Trump has announced plans to nominate economist Stephen Miran to temporarily fill a vacant seat on the Federal Reserve Board of Governors. If confirmed by the Senate, Miran will step into the position left by Adriana Kugler, who recently departed the Fed months before her term’s official end in January 2026.

Miran, a senior economic adviser and close Trump ally, is known for his support of the former president’s economic policies — especially his controversial stance on tariffs. He has consistently argued that tariffs are not inherently inflationary, diverging from the views of Federal Reserve Chair Jay Powell and other senior Fed officials.

Trump confirmed the nomination via Truth Social, stating that Miran would serve on the board through January 2026 while a search for a permanent replacement continues. If approved, Miran will gain voting power on the Federal Open Market Committee (FOMC), directly influencing U.S. monetary policy.

A Strategic Appointment Amid Tensions with Powell

Trump’s choice comes amid growing tensions between the former president and the Fed, particularly over its decision to hold interest rates steady. Trump has called for a steep rate cut of up to 3 percentage points, citing economic headwinds and the need to ease borrowing costs.

Fed Chair Jay Powell has maintained that a thorough assessment of Trump’s tariff policies is needed before any adjustments to the current interest rate range of 4.25–4.5% can be made.

Miran, who holds a PhD in economics from Harvard and previously served as a Treasury policy adviser, is expected to align with other Trump-appointed Fed officials, including Christopher Waller and Michelle Bowman, in supporting a more aggressive push for rate cuts.

Miran’s Policy Outlook and Criticism of the Fed

In recent interviews, Miran has accused Fed officials of suffering from “tariff derangement syndrome” — a term he uses to criticize what he sees as an exaggerated concern over inflation caused by tariffs. He contends that Trump’s fiscal strategies have been “extremely disinflationary,” and that the Fed’s current stance is too restrictive.

Miran has also been critical of Powell’s leadership, particularly his call for fiscal stimulus during the COVID-19 crisis in 2020. He believes Powell has been too slow to adjust monetary policy in response to changing economic conditions.

Following Trump’s announcement, JPMorgan updated its forecast to include a potential quarter-point rate cut at the Fed’s next meeting in September — a shift reflecting growing expectations of dovish moves.

Potential Restructuring of the Federal Reserve

Miran’s appointment may also reflect broader ambitions by the Trump camp to reshape the Fed’s institutional framework. Prior to joining the administration, Miran advocated for reforms including:

-

Shorter term lengths for Fed officials.

-

Turning the 12 regional Federal Reserve banks into public institutions.

-

Making it easier to dismiss central bank officials.

-

Preventing the “revolving door” between the Fed and the executive branch.

In a policy document published by the conservative Manhattan Institute, Miran criticized the Fed’s current design as an “unchecked and broad-ranging authority” that risks overstepping its intended democratic role.

Trump is widely expected to use the temporary appointment to position a long-term candidate who could challenge Powell’s authority — or even replace him as Fed Chair when his term ends in May 2026.