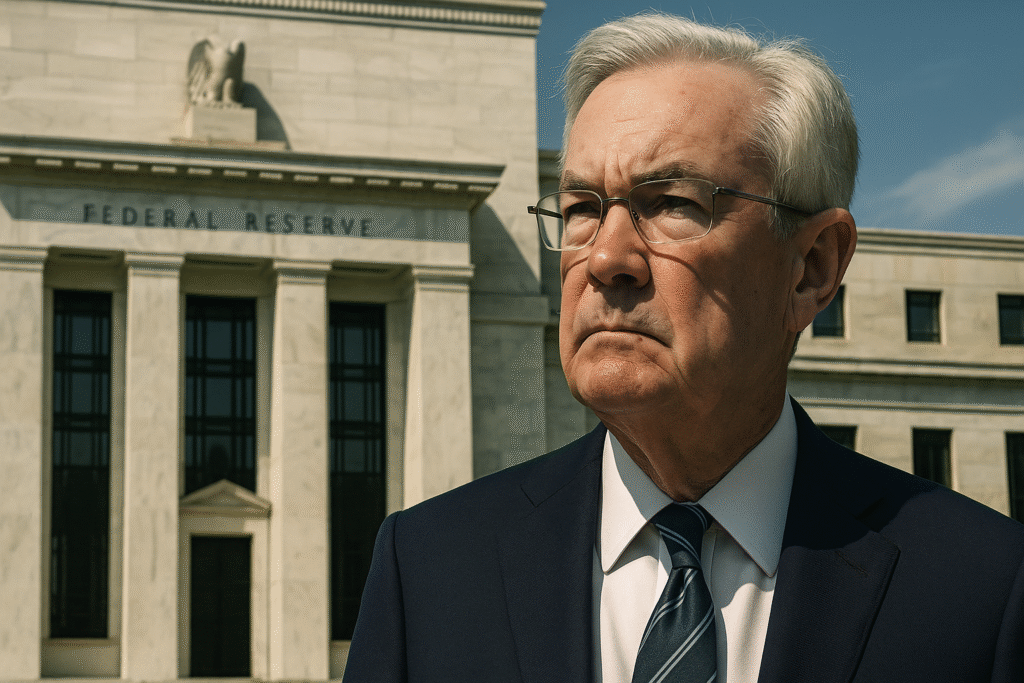

U.S. Treasury Secretary Scott Bessent has called for a comprehensive investigation into the Federal Reserve, signaling an intensifying campaign by the Trump administration against the central bank’s leadership and operations.

In remarks made during an interview with CNBC on Monday, Bessent stated:

“What we need to do is examine the entire Federal Reserve institution and whether they have been successful.”

His comments come amid growing frustration within the Trump administration over the Fed’s monetary policy stance, particularly its decision to maintain current interest rates rather than implementing further cuts. President Donald Trump and his top officials have repeatedly criticized Fed Chair Jay Powell, with Trump recently asking Republican lawmakers whether Powell should be dismissed — though he later clarified he had no plans to remove him unless misconduct was uncovered.

The criticism has expanded beyond monetary policy. The administration is now scrutinizing the Federal Reserve’s $2.5 billion renovation project at its Washington, D.C. headquarters. Russell Vought, Trump’s budget director, has alleged serious mismanagement in the renovation, which is now $700 million over budget. The project involves modernizing two historic buildings overlooking the National Mall, originally constructed in the 1930s.

Bessent compared the situation to regulatory failures in other sectors, stating:

“If the FAA had made this many mistakes, we would go back and look at why this has happened.”

The Federal Reserve’s inspector general has launched a review of the renovation, and Chair Powell has written to senior lawmakers outlining steps being taken to control costs. The Fed also released a video tour of the buildings to provide transparency on the project’s scope.

Tensions have risen in recent months as Trump pressures the Fed to lower rates further. After a series of rate cuts totaling 1 percentage point between September and December, the central bank has held the benchmark interest rate steady between 4.25% and 4.5%, citing caution over the effects of the ongoing trade war on inflation.

Inflation remains a contentious issue. While the Consumer Price Index for June showed a 2.7% year-on-year increase—the fastest rise since February—Bessent downplayed concerns, dismissing the Fed’s inflation warnings as “fear-mongering over tariffs” and pointing instead to what he called “great inflation numbers.”

Despite being considered a potential successor to Powell, Bessent appears likely to remain at the Treasury for now. Trump recently expressed satisfaction with Bessent’s current role and mentioned National Economic Council Chair Kevin Hassett as a possible candidate to lead the Fed when Powell’s term ends in May 2026.

The ongoing dispute highlights the Trump administration’s increasing willingness to confront the traditionally independent Federal Reserve, raising broader questions about the future of U.S. central banking governance.