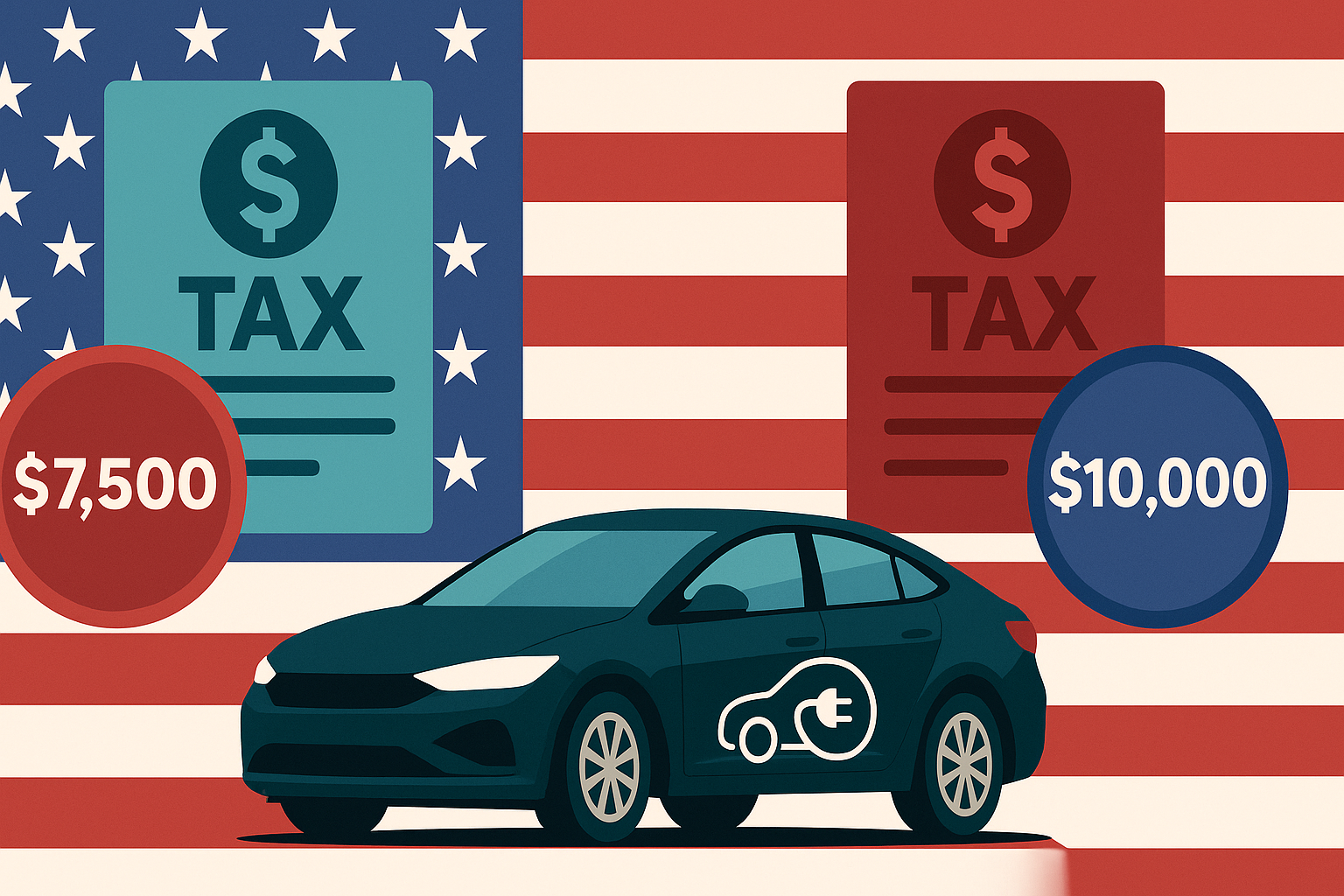

If you’re in the market for a new electric vehicle (EV), now might be the best — and last — time to take advantage of a rare opportunity to combine tax incentives from both the Biden and Trump administrations.

Thanks to overlapping federal programs, you can potentially save up to $17,500 on a new EV purchase — but only if you act quickly. The Biden-era Inflation Reduction Act offers incentives that will expire on September 30, while the Trump administration’s newly signed “Big Beautiful Bill” introduces its own generous tax benefits for auto buyers beginning this year.

Biden’s Inflation Reduction Act (IRA): Up to $7,500 in EV Credits

Signed into law in 2022, President Joe Biden’s Inflation Reduction Act provides a federal tax credit of up to $7,500 for buyers of new plug-in or fuel-cell electric vehicles. This credit applies only to vehicles assembled in North America and is subject to income caps:

- $150,000 for individuals

- $300,000 for joint filers

The credit also applies to used EVs, offering up to $4,000 for eligible purchases — but these don’t qualify for the Trump-era credits.

Deadline: This credit ends on September 30, 2025, under Trump’s new legislation.

Trump’s “Big Beautiful Bill”: Up to $10,000 in New Loan Tax Credits

President Trump’s newly passed “Big Beautiful Bill” introduces a tax credit of up to $10,000 — not on the car itself, but on the interest paid on loans for new vehicles. To qualify, the vehicle must:

- Weigh under 14,000 pounds

- Be assembled in the United States

- Be purchased between 2025 and 2028

This credit is income-restricted and not available for fleet, leased, or commercial vehicles. It begins to phase out at:

- $100,000–$150,000 for individuals

- $200,000–$250,000 for joint filers

How to Combine the Tax Credits

To take full advantage of both programs, buyers must purchase an eligible EV before the September 30 deadline for Biden’s $7,500 credit — and finance the car to qualify for Trump’s interest-related tax credit starting in 2025.

Here’s how it could work:

- Buy a new, qualifying EV by Sept. 30, 2025

- Claim $7,500 from Biden’s credit on your 2025 tax return

- Claim up to $10,000 from Trump’s bill by deducting interest on your auto loan over the life of the loan (starting in 2025)

Is This the Smartest Financial Move?

According to Kelley Blue Book, the average price of a new EV is currently $57,734, roughly $1,500 more than the average gas-powered car, even after applying Biden’s credit. However, long-term savings can be significant:

- Five-year fuel cost for gas cars: ~$9,490

- Five-year fuel cost for EVs: ~$4,295

Used EVs, meanwhile, are about $20,000 cheaper on average than new models, and qualify only for the $4,000 Biden credit, not Trump’s.

Final Thoughts

Combining these two tax credits could dramatically reduce the cost of your new EV — but time is limited. To benefit from both, buyers should act before Biden’s program phases out and ensure their purchase meets the strict criteria of both laws. Always consult a tax advisor to ensure eligibility and to maximize your savings.