President Donald Trump is intensifying efforts to push his sweeping tax legislation through the Senate before the July 4 deadline, as the bill encounters growing resistance and procedural obstacles.

Returning to Washington from a NATO summit in Europe, Trump refocused his attention on domestic priorities, particularly the ambitious tax plan that the White House has dubbed the “Big Beautiful Bill.” The legislation includes a range of provisions: an expansion of the child tax credit, creation of children’s investment accounts, increased estate tax exemptions, expanded deductions for high-tax states, new limits on Medicaid and food stamps, and tax exemptions on tips and overtime pay.

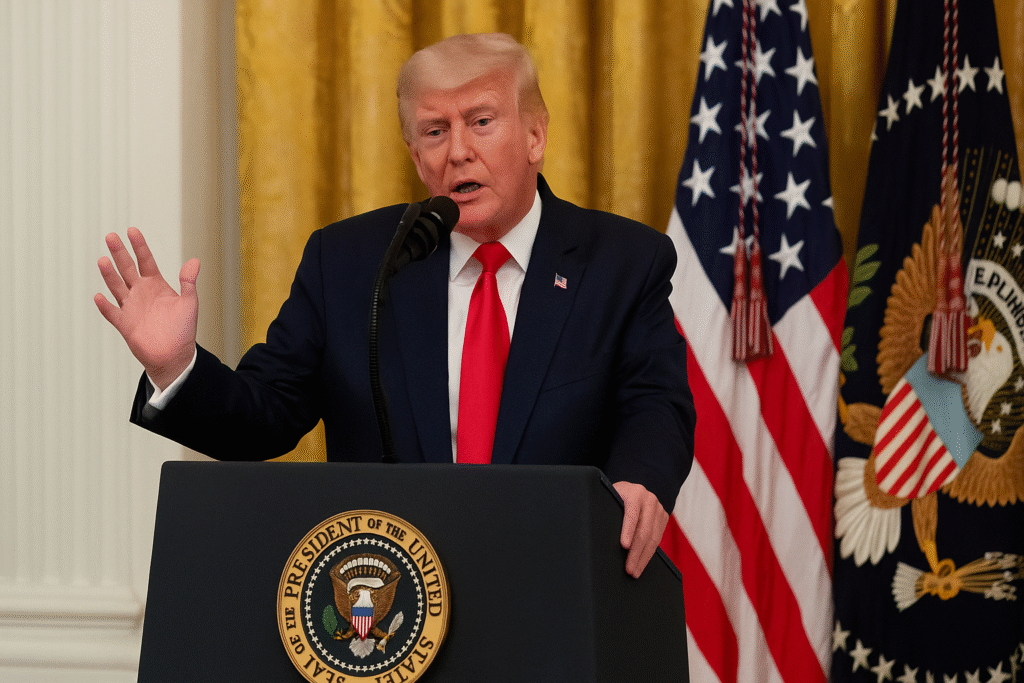

At a White House event on June 26, Trump appealed to working Americans, highlighting how the bill would provide relief to individuals like gig economy workers. “We hope so,” Trump told reporters when asked if he still expects the bill to reach his desk by Independence Day.

Quiet Lobbying Efforts in the Senate

Behind the scenes, the administration is in full campaign mode to secure Senate support. Press Secretary Karoline Leavitt confirmed that the president has been personally engaging with lawmakers. “I saw some senators rolling out of the Oval Office the other day,” she noted. “The president remains on the phones talking to his friends in the Senate.”

One of those friends is Senator Ron Johnson (R-Wis.), a key holdout. Trump met with Johnson before leaving for Europe, and Vice President JD Vance has also been lobbying his former Senate colleagues, attending recent GOP luncheons and private meetings to rally support.

Despite these efforts, concerns remain within Republican ranks. Some senators fear the bill’s deep cuts to Medicaid and its potential to add trillions to the national deficit. With a slim majority, Trump can only afford to lose three Republican votes in the Senate.

Parliamentarian Ruling Forces Revisions

On June 26, the Senate was forced to revise the bill after Senate Parliamentarian Elizabeth McDonough ruled that several Medicaid-related provisions violated budget rules. Those components were seen as essential to appeasing House conservatives, adding further complications to the bill’s path forward.

The House-passed version, which included stricter Medicaid restrictions and other right-leaning provisions, will now need to be reconciled with a Senate-approved version stripped of those elements. Some House Republicans are already signaling opposition to the amended bill.

Representative Marjorie Taylor Greene (R-Ga.) said she currently cannot support the bill. “I love President Trump and I really want to vote to pass his agenda,” Greene posted on X, “but between the far-left Senate Parliamentarian stripping out many of our good provisions and special interest lobbyists sneaking in poison pills… I’m currently a NO.”

Trump Urges GOP to Stay in Town

Trump, frustrated by delays, urged Republican lawmakers to cancel their planned July 4 recess to finalize the bill. “To my friends in the Senate, lock yourself in a room if you must, don’t go home, and GET THE DEAL DONE THIS WEEK,” he wrote on social media.

At the June 26 event, Trump also criticized unnamed Republican “grandstanders” for threatening to derail the bill. “We don’t want to have grandstanders where one or two people raise their hand and say, ‘we’ll vote no.’ Not good people,” he said.

Personal Stories Highlight Policy Impact

To reinforce the human impact of the bill, the White House brought several Americans on stage. One was Maliki Krieski, a DoorDash driver and gift shop owner from Wisconsin who cares for a diabetic son. “No tax on tips is huge,” she said, emphasizing the importance of policies that support working families.

What’s Next?

With the July 4 deadline looming, House Speaker Mike Johnson acknowledged the challenges but remained hopeful. “It doesn’t make it easier, but you know me—hope springs eternal,” he said.

The outcome of the bill remains uncertain as GOP lawmakers weigh political pressure from Trump against concerns over the bill’s cost, social program cuts, and procedural setbacks.