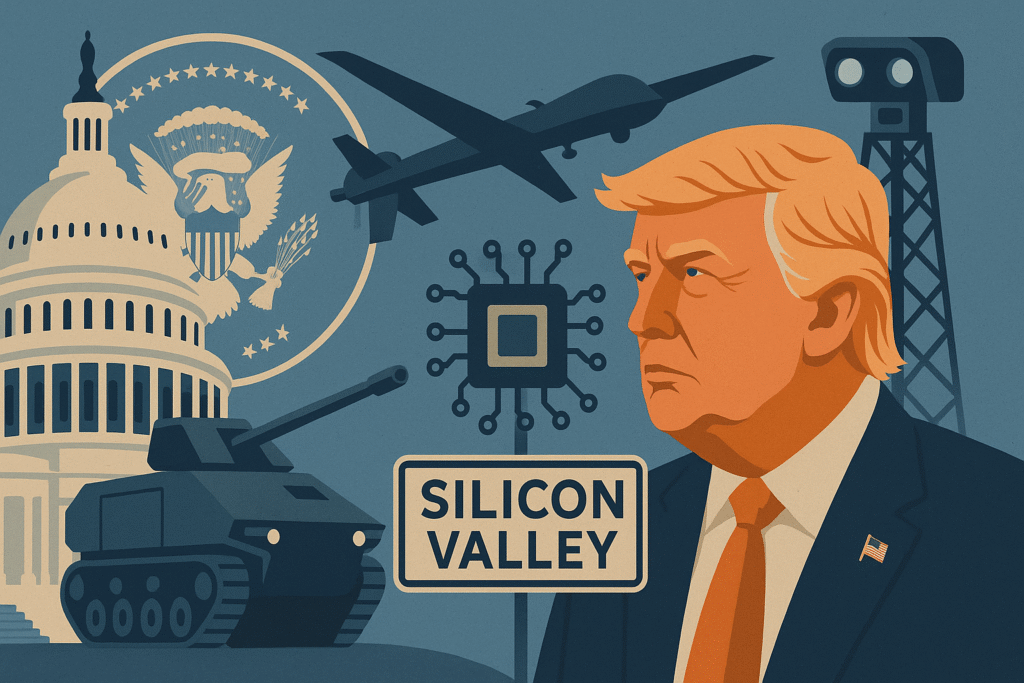

In a sweeping economic and military initiative, former U.S. President Donald Trump’s latest tax and spending bill—dubbed the “big, beautiful bill”—has become a windfall for Silicon Valley’s fast-growing defense tech sector. With nearly $300 billion allocated to modernize the military, strengthen homeland security, and advance defense infrastructure, the legislation is poised to reshape how America invests in technology-driven security solutions.

Silicon Valley’s Rising Defense Giants

Among the biggest winners is Anduril Industries, a California-based defense tech company specializing in autonomous surveillance systems. Co-founded by Oculus founder Palmer Luckey and backed by billionaire investor Peter Thiel, Anduril is the only approved supplier of autonomous towers currently contracted by U.S. Customs and Border Protection (CBP). The bill allocates $6 billion to border security tech, much of which will be spent on these towers, effectively securing Anduril a dominant position in this niche.

Another major beneficiary is Palantir Technologies, the data analytics firm also co-founded by Thiel. In April, Palantir secured a $30 million deal with U.S. Immigration and Customs Enforcement (ICE) to build a digital platform known as “ImmigrationOS.” The U.S. Army has also consolidated its various contracts with Palantir into one deal potentially worth $10 billion over the next decade.

Palantir’s government business is booming: a recent earnings report showed a 50% revenue increase, driven largely by public sector sales, and the company now surpasses traditional contractors like Lockheed Martin in market capitalization.

Billions Flow into Innovation and AI Defense Systems

The bill directs $150 billion to the Department of Defense for modern drone systems, naval innovations, and nuclear deterrent modernization. An additional $165 billion goes to the Department of Homeland Security. In parallel, Trump’s “Golden Dome” missile defense project aims to deploy at least $150 billion to build a new system using AI, satellites, and sensors.

Other tech firms, including Anthropic, Google, OpenAI, and xAI, recently signed $800 million in AI contracts with the Pentagon, signaling an acceleration in defense-related tech partnerships.

Close Ties Between Government and Tech

Trump’s administration has brought several executives from Palantir and Anduril into government roles. Gregory Barbaccia, formerly head of intelligence at Palantir, now serves as the government’s chief information officer. Michael Obadal, an Anduril director, has been nominated to a top civilian post at the Army. Meanwhile, Palantir CTO Shyam Sankar joined the Army Reserve to help develop the U.S.’s new AI military-industrial framework.

Family members and administration officials are also invested in these companies. Donald Trump Jr. is connected to 1789 Capital, an early backer of Anduril. White House staffer Stephen Miller holds at least $100,000 in Palantir stock, though officials claim he has recused himself from relevant decision-making.

Private Sector and Wall Street Bet on a Defense Tech Boom

Interest in defense innovation is spreading quickly. Startups and investors flocked to last month’s Reindustrialize Conference in Detroit, where Silicon Valley entrepreneurs met with government officials and intelligence leaders to explore defense collaboration. Startups like Regent, a Thiel-backed seaglider firm, are shifting toward “dual-use” strategies—serving both commercial and defense markets.

Large firms are also scaling up. Government contractor Booz Allen Hamilton tripled its investment fund for defense startups to $300 million, pledging 25 new investments over five years. The company emphasized the urgency of technological competition with China as a driving force.

“We are in a massive technological race with China,” said Booz Allen CFO Matt Calderone. “The U.S. is now beginning to match China’s strategy of aligning public and private sector resources.”

Conclusion

Trump’s economic and security agenda is redefining the U.S. defense landscape. By fusing Silicon Valley innovation with federal defense funding, the administration has opened the door for a new era of high-tech militarization. With billions now flowing into AI, surveillance, and space tech, this alignment could reshape both national security policy and the tech industry’s future.