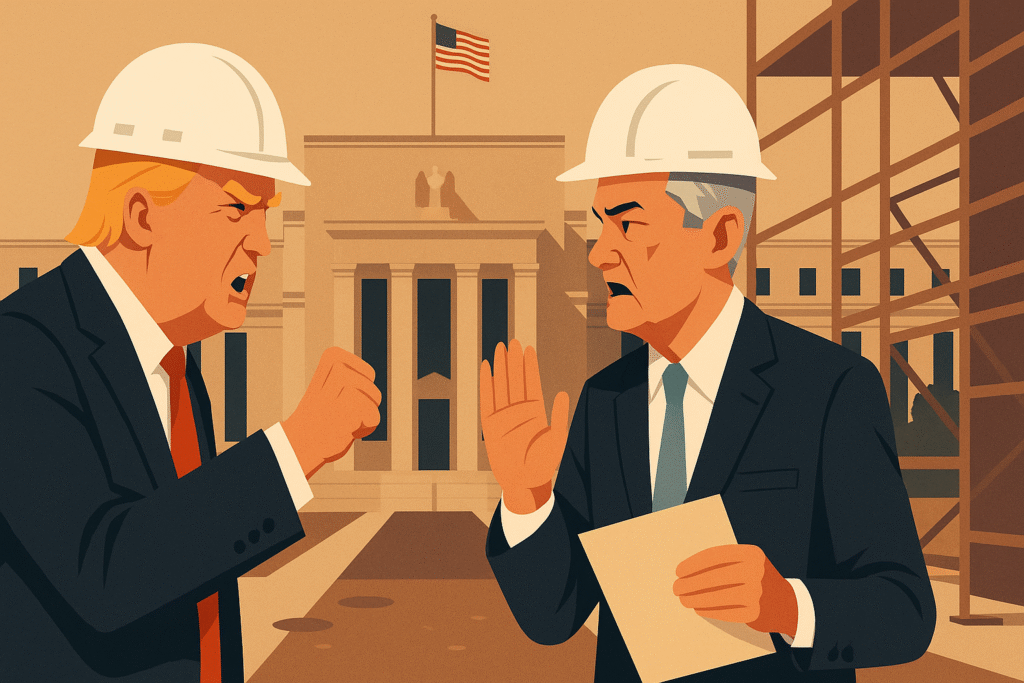

In a rare and highly publicized visit to the Federal Reserve, U.S. President Donald Trump and Federal Reserve Chair Jay Powell engaged in a tense exchange over the cost of renovations at the Fed’s headquarters and the direction of interest rate policy. The encounter, captured on live television, underscored mounting tensions between the White House and the traditionally independent central bank.

A Confrontation at the Construction Site

Wearing white construction helmets, Trump and Powell toured the renovation site of the Fed’s Marriner S. Eccles Building in Washington. During the visit, Trump questioned the project’s ballooning budget, claiming costs had jumped to $3.1 billion from an initial $2.7 billion. Powell, visibly surprised, responded that he was unaware of such a figure, asserting the central bank’s estimate remained at $2.5 billion.

Trump produced a piece of paper from his pocket, stating the revised figure “just came out,” prompting Powell to explain that Trump’s number likely included separate renovations to the Martin Building, completed five years ago.

The confrontation highlights the White House’s escalating criticism of the central bank’s $700 million budget overrun. The Fed has maintained that the increased cost stems from efforts to preserve the building’s historic architecture, which dates back nearly 90 years.

A New Front in Trump’s Criticism of the Fed

The visit follows weeks of public attacks by Trump on Powell, whom he has labeled a “numbskull.” Trump has repeatedly urged the Fed to cut interest rates, arguing that lower borrowing costs would stimulate the economy and reduce the government’s debt-servicing burden.

“I just want to see one thing — it’s very simple — interest rates have to come down,” Trump said during the visit.

He added that he “didn’t think it was necessary” to remove Powell from office.

Despite the pressure, the Fed has maintained its benchmark interest rate between 4.25% and 4.5% throughout the year, citing concerns that Trump’s sweeping tariffs could contribute to inflation. Economists anticipate that rates will remain unchanged at the Fed’s next policy meeting.

Concerns Over Central Bank Independence

The clash has raised concerns among economists and investors who view the Fed’s independence as critical to the credibility of U.S. monetary policy. Dan Ivascyn, Chief Investment Officer of bond fund giant Pimco, warned that any attempts to undermine that independence would be “very bad for markets.”

Although the Supreme Court has ruled that the White House cannot fire Powell or other Fed governors over policy disagreements, some analysts suggest the administration could use the renovation budget as a pretext for removal “for cause.”

Markets Remain Calm, For Now

Despite the tension, financial markets remained stable. The U.S. dollar rose 0.2% against a basket of major currencies on Friday, while 10-year Treasury yields held steady at 4.39%.

An Unprecedented Visit

Presidential visits to the Federal Reserve are extremely rare. The last known visit was by President George W. Bush in 2006 to witness Ben Bernanke’s swearing-in. Trump’s appearance, accompanied by several high-ranking administration officials, reflects his administration’s heightened focus on monetary policy and spending.

Trump was joined by:

-

Russell Vought, Director of the Office of Management and Budget

-

Senators Thom Tillis and Tim Scott

-

James Blair, Deputy Chief of Staff

-

William Pulte, Director of the Federal Housing Finance Agency

-

Mark Paoletta, OMB General Counsel

-

Stuart Levenbach, National Public Planning Commission Official

The confrontation, both symbolic and substantive, has deepened the political spotlight on the Federal Reserve and set the stage for ongoing battles over economic policy ahead of the 2026 election.