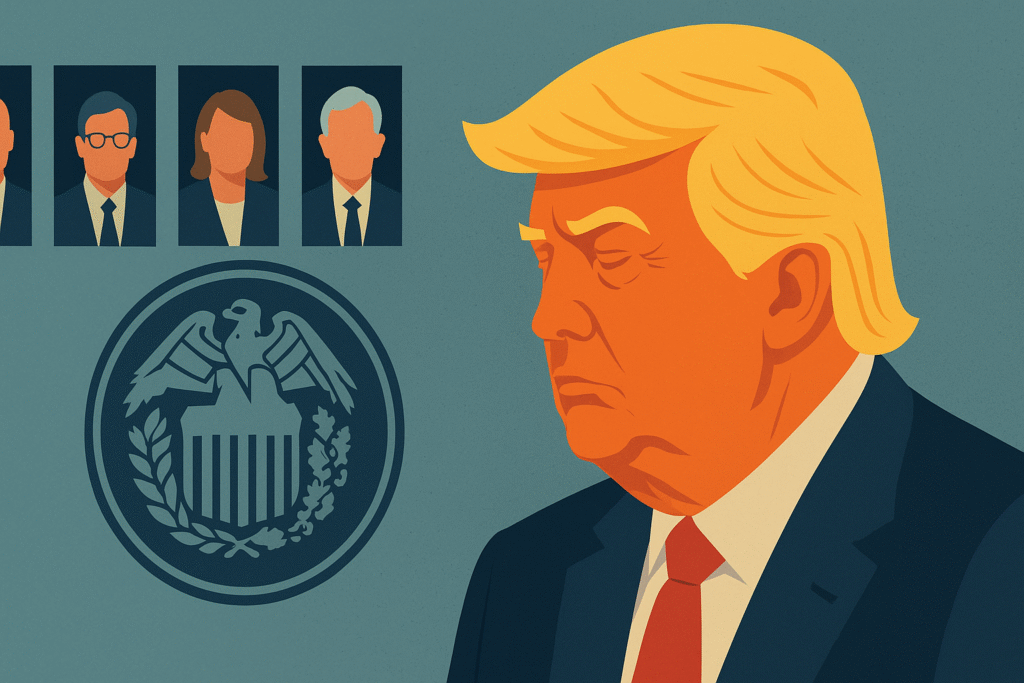

President Donald Trump revealed on Wednesday that he is actively considering a shortlist of candidates to replace Federal Reserve Chair Jerome Powell, whose term is set to expire in May 2026. Speaking at the NATO summit in the Netherlands, Trump said he has already narrowed his choices to “three or four people,” adding that Powell would be leaving “pretty soon,” and described him as “terrible.”

Although Trump did not disclose any specific names, reports from Bloomberg News indicate that Treasury Secretary Scott Bessent, former Fed Governor Kevin Warsh, and current Fed Governors Michelle Bowman and Christopher Waller are among those under consideration. Notably, both Bowman and Waller have recently aligned with Trump’s position, supporting an interest rate cut as early as the Federal Reserve’s late July meeting.

Trump has long expressed dissatisfaction with Powell, whom he originally nominated in 2017, accusing him of mismanaging monetary policy. In his latest comments, Trump reiterated his belief that the Fed’s current benchmark interest rate—ranging between 4.25% and 4.5%—should be reduced to around 2.25%. He argues that such a move would significantly reduce the cost of servicing the national debt, which now exceeds $36 trillion, potentially saving the federal government $900 billion annually.

“The U.S. has no inflation and a strong economy,” Trump insisted, blaming Powell for what he sees as unnecessarily high borrowing costs. “Because of him, we’ll be paying [interest] for years,” Trump said. He also attacked Powell personally, describing him as a “very average mentally person” and, in a recent social media post, calling him a “numbskull,” “dumb guy,” and a “Trump hater.”

Despite the political rhetoric, the Federal Reserve remains an independent institution designed to operate free from direct political influence. It last adjusted interest rates by a full percentage point in late 2024 but has since held rates steady for four consecutive meetings. Fed Chair Powell has defended the cautious approach, emphasizing the need to assess the impact of Trump’s new tariffs on inflation.

“Our concern is that import levies may soon begin influencing retail prices more significantly,” Powell told the House Financial Services Committee on June 24. While the Fed’s preferred inflation measure has declined to 2.5%, it remains slightly above its 2% target. Powell noted that the central bank is taking a “wait-and-see” stance, citing the strong labor market and uncertainty over whether inflationary pressures will persist or prove temporary.

“I said to him, ‘There’s no inflation,’” Trump recalled from a recent meeting with Powell at the White House. “He said, ‘Maybe there’ll be some.’ I said, ‘If there is, you raise the rate.’”

However, many economists warn that cutting rates preemptively could entrench inflation expectations, potentially triggering a cycle of wage and price increases that would be more difficult to control.

As Trump continues to pressure the Fed to act swiftly, the debate over interest rates, inflation, and the independence of U.S. monetary policy appears poised to intensify in the months leading up to Powell’s scheduled departure.