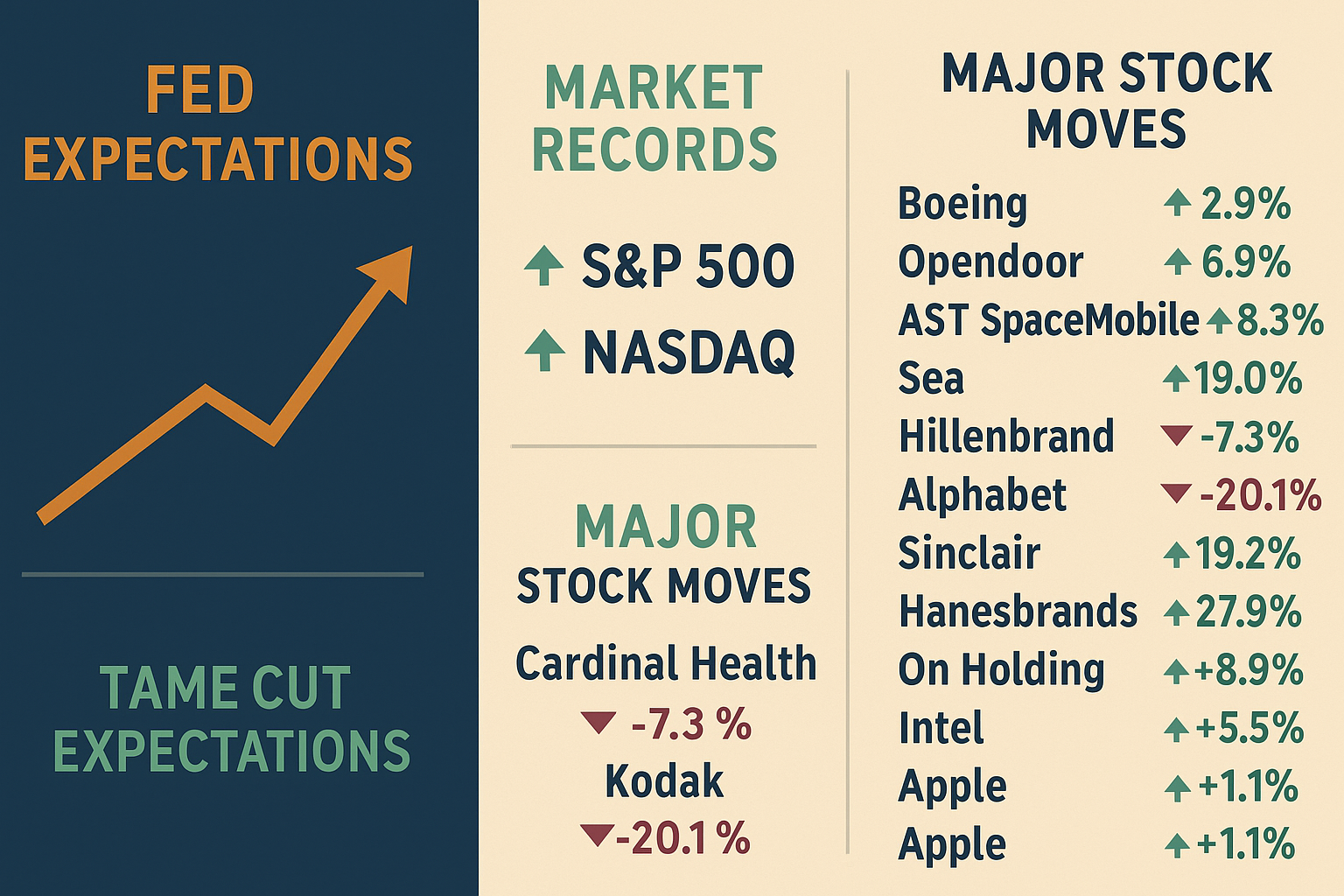

U.S. stocks climbed to fresh record highs on Tuesday, with the S&P 500 and Nasdaq leading gains, after a mild inflation reading strengthened expectations for a Federal Reserve interest rate cut in September.

The annual inflation rate for July rose 2.7%, in line with June’s figure and below forecasts of 2.8%. Core inflation, which excludes food and energy, increased 3.1%, slightly under the expected 3%. Economists noted some early signs of tariffs feeding into consumer prices, but not yet at levels of concern.

“Although core annual inflation is back to its highest level since February, today’s print is not hot enough to derail the Fed from cutting rates in September,” said Seema Shah, Chief Global Strategist at Principal Asset Management.

Following the release, the CME FedWatch tool showed markets pricing in a 94% probability of a September rate cut, up from 85% before the data. Lower interest rates would reduce borrowing costs, encouraging business investment and consumer spending.

Some economists, however, urged caution. Joe Brusuelas, Chief Economist at RSM, said the Fed may hold off until it is certain the tariff impact is temporary, predicting one cut later this year, possibly in December.

Market Performance

-

Dow Jones Industrial Average: +1.1% (↑ 483.52 points) to 44,458.61

-

S&P 500: +1.13% (↑ 72.31 points) to 6,445.76

-

Nasdaq Composite: +1.39% (↑ 296.50 points) to 21,681.90

-

10-year Treasury Yield: rose to 4.289%

Corporate Highlights

-

Boeing: Delivered 48 planes in July, its highest July total since 2017. Stock ↑ 2.92%.

-

Opendoor: Shares ↑ 6.93% after ProCap Acquisition Corp.’s CEO disclosed an investment.

-

Cardinal Health: Buying Solaris for $1.9 billion; stock ↓ 7.34%.

-

AST SpaceMobile: Plans 45–60 satellite launches by 2026. Shares ↑ 8.36%.

-

Mercury Systems: Beat fiscal Q4 estimates; shares surged 26.95%.

-

Sea Ltd.: Quarterly results exceeded forecasts; stock ↑ 19.01%.

-

Hillenbrand: Beat Q3 forecasts, raised sales guidance; shares ↑ 18.45%.

-

Eastman Kodak: Posted quarterly loss, warned over debt repayment; shares ↓ 20.09%.

-

Celanese: Beat Q2 estimates but warned of slowdown; shares ↓ 13.07%.

-

Alphabet: Received $34.5B offer from AI startup Perplexity for Google Chrome; shares ↑ 1.16%.

-

Circle: Wider-than-expected loss, but revenue beat; shares ↑ 1.27%.

-

Sinclair: Exploring merger or spinoff; shares ↑ 19.19%.

-

Hanesbrand: Near $5B sale to Gildan Activewear; shares ↑ 27.95%.

-

On Holding: Raised sales forecast; shares ↑ 8.87%.

-

Intel: CEO Lip-Bu Tan met with Trump at White House; shares ↑ 5.46%.

-

Apple: Accused by Elon Musk of antitrust violations over OpenAI favoritism; shares ↑ 1.09%.

-

Smithfield Foods: Raised profit forecast; shares ↓ 2.58%.

-

Nvidia: Edged higher after Trump signaled openness to downgraded chip sales to China.

Cryptocurrency Moves

Bitcoin adoption by corporations continues to grow:

-

Metaplanet (Japan): Bought 518 BTC for $61.4M, bringing holdings to 18,113 BTC (~$2.15B).

-

The Smarter Web Company (UK): Acquired 295 BTC for $35.2M, raising total holdings to 2,395 BTC (~$284.8M).

Next Data Point

Before markets open on Aug. 13, the Producer Price Index (PPI) for July will offer insight into inflation from the perspective of businesses, potentially influencing Fed rate cut expectations further.