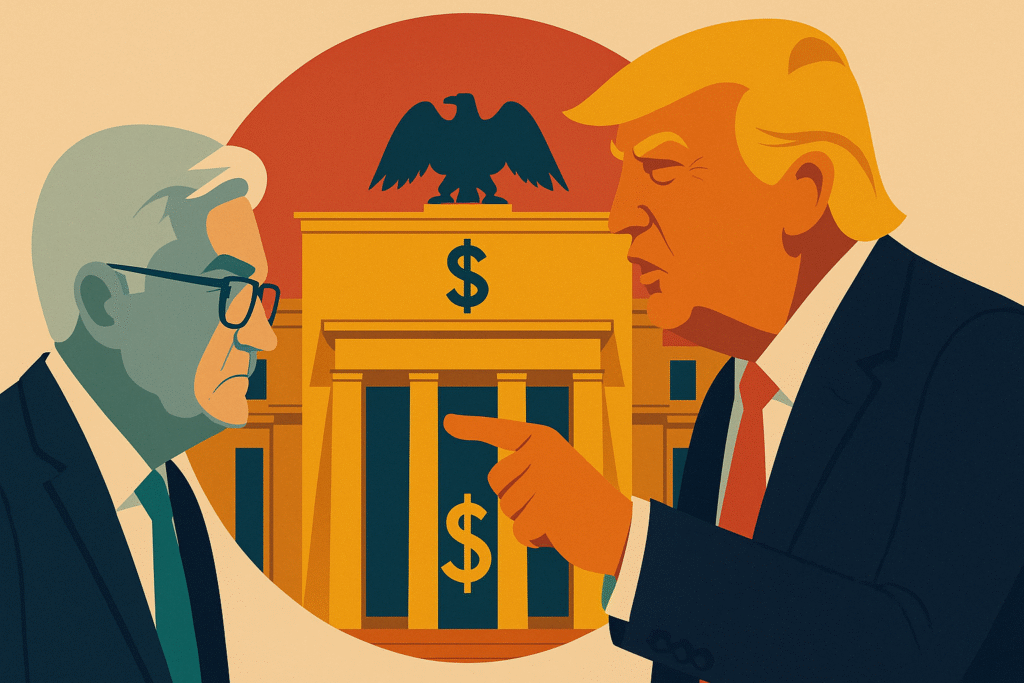

President Donald Trump intensified his campaign against the U.S. Federal Reserve on Thursday with a dramatic and unprecedented visit to the central bank’s Washington headquarters, confronting Chair Jerome Powell over interest rate policy and the institution’s controversial renovation project.

As he toured the Fed’s Marriner S. Eccles Building — currently undergoing extensive refurbishment — Trump publicly pressured Powell to cut interest rates and accused the central bank of excessive spending. The interaction was broadcast live, capturing a tense moment as Trump clapped Powell on the back and quipped:

“I would love it if he lowered interest rates.”

Historic and Tense Exchange

The encounter marked one of the most direct challenges by a sitting president to the Federal Reserve since its establishment. Former Fed official David Wilcox noted:

“It’s exceedingly rare for the president to come to the Federal Reserve, and it’s never been done before under unfriendly circumstances.”

Trump criticized the central bank’s reported $3.1 billion cost for renovating the Eccles building and adjacent facilities. Powell countered that the true figure was closer to $2.5 billion, with Trump’s estimate including a previously completed project.

While the televised encounter was marked by visible tension, sources familiar with the off-camera discussions described them as “more respectful.” Powell reportedly left reassured that Trump had no immediate intention of firing him.

Pressure Mounts Within the Fed

Despite private reassurances, the Fed is under mounting pressure. Current and former officials describe the internal environment as a “pressure cooker,” with growing anxiety among the institution’s employees.

“It’s not a great time to work for the central bank,” said Vincent Reinhart, a former senior Fed official now at BNY Investments.

Critics within the administration have even mocked Fed staff as academic elites. Treasury Secretary Scott Bessent, a potential Powell successor, recently likened Fed economists to recipients of “universal basic income for academic economists.”

Claudia Sahm, a former Fed economist, expressed concern for both the institution’s credibility and her former colleagues:

“I’m worried about the institution and, of course, I’m worried about my friends who are there.”

Powell’s Future Under Threat?

Although the Supreme Court has indicated that the president cannot dismiss Powell over policy disagreements, some analysts fear Trump may attempt to remove him “for cause” by citing the renovation project’s budget overruns.

“This is, rather transparently, an attempt to build a pretext for dismissing Powell,” said Wilcox.

Daniel Tarullo, a Harvard law professor and former Fed official, dismissed the notion of misconduct:

“I just can’t believe that there’s any malfeasance or gross neglect. It’s just not Jay.”

Powell’s term expires in May 2026, and he has made it clear he has no intention of stepping down early. Financial leaders, including Pimco’s Dan Ivascyn and JPMorgan Chase CEO Jamie Dimon, have warned that undermining the Fed’s independence could trigger market instability.

A Battle Over Rates and Institutional Credibility

Trump’s ongoing frustration with the Fed stems largely from its decision to keep interest rates between 4.25% and 4.5% — a level he believes is choking economic growth. The Fed has resisted further cuts, citing inflationary concerns stemming from Trump’s own tariff policies.

Trump has called Powell a “numbskull” and a “stubborn mule,” demanding rates be slashed to around 1%, a level typically reserved for economic crises. Some economists have compared Trump’s tactics to those of authoritarian leaders like Turkey’s Recep Tayyip Erdoğan, who dismissed central bank heads for not cutting rates.

Despite expert criticism, Trump’s anti-Fed rhetoric resonates with his political base. A recent Gallup poll showed just 37% of Americans express confidence in Powell — a sign that the Fed’s public standing may be eroding.

Outlook

With political tensions intensifying and Powell’s term nearing its end, many observers worry the independence of the central bank may be at risk.

“Next year, they’ll have a new chair and the politics are potentially going to come inside the building,” warned Sahm.

As Trump continues to wield public pressure, the Federal Reserve’s ability to remain an impartial steward of the U.S. economy faces an unprecedented test.