President Donald Trump has renewed his public campaign to pressure Federal Reserve Chairman Jerome Powell to significantly cut interest rates — this time through an unconventional approach: a handwritten letter shared on social media.

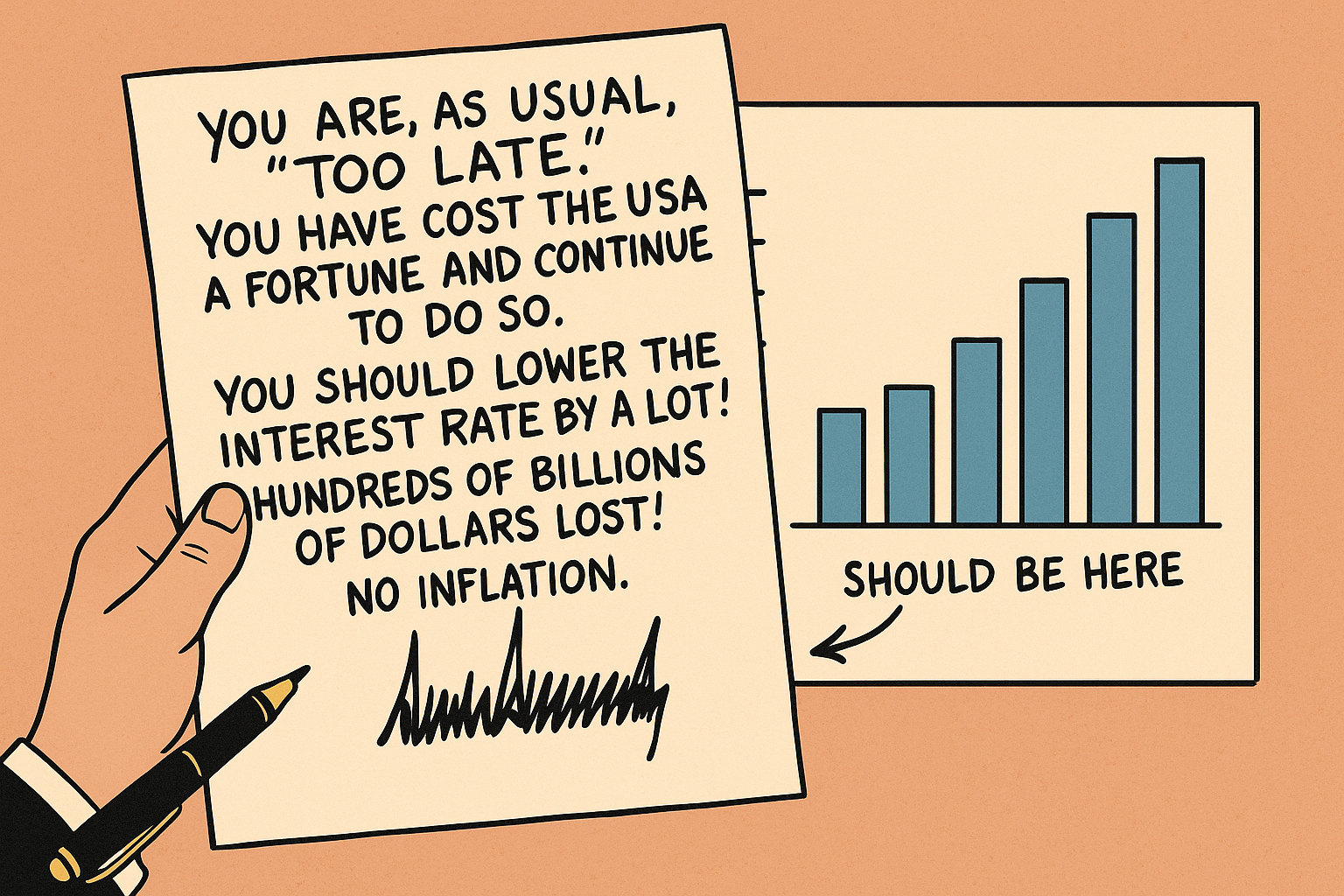

In a note posted to Truth Social on June 30, Trump criticized Powell for failing to lower rates, writing, “You are, as usual, ‘Too Late.’ You have cost the USA a fortune and continue to do so.” He called for deep rate cuts, adding, “Hundreds of billions of dollars [are] being lost! No inflation.”

The letter was accompanied by a global comparison of central bank interest rates, with Trump circling figures ranging from Switzerland’s 0.25% to Japan’s 0.5%, and noting that the U.S. rate of 4.5% ranked among the highest globally. He included arrows pointing to a lower range and wrote, “Should be here,” implying the U.S. rate should align more closely with the ultra-low policies of several foreign economies.

White House Press Secretary Karoline Leavitt held up an enlarged version of the note during Monday’s press briefing. “This is a president who was a businessman first. He knows what he’s doing,” she said, arguing that Americans deserve access to cheaper credit. “Interest rates are still too high.”

Despite Trump’s repeated public criticism and personal appeals, the Federal Reserve has kept its benchmark rate steady at 4.25% to 4.5% for four consecutive meetings. The central bank has cited uncertainty surrounding the inflationary impact of Trump’s recently implemented tariffs on imported goods.

Testifying before the House Financial Services Committee last week, Powell acknowledged that inflation has cooled — registering at 2.4% in May — but warned that new tariffs could spark a rebound in prices. “Tariffs this year are likely to push up prices and weigh on economic activity,” Powell said. “It’s not yet clear whether this is a one-time increase or something more persistent.”

Powell also reaffirmed that the Fed will evaluate the economic impact of the trade measures before adjusting policy.

Although Trump has criticized Powell sharply, he stated in April that he has “no intention” of firing the Fed chair, whom he originally nominated in 2017. Legally, the president cannot remove the Federal Reserve Chair at will. Powell’s current term as chair runs through May 2026, while his broader term on the Federal Reserve Board extends to 2028.

Nevertheless, Trump recently said he has begun searching for Powell’s replacement, indicating he is considering “three or four” candidates. Among those reportedly under consideration is current Treasury Secretary Scott Bessent, according to Bloomberg News.

While the Trump administration has pursued a broader effort to expand presidential authority to remove leaders of independent federal agencies — an issue currently before the Supreme Court — officials clarified they are not seeking that authority specifically for the Federal Reserve.

In a recent ruling, a majority of justices signaled skepticism about allowing a president to fire the Fed chair, describing the institution as a “uniquely structured, quasi-private entity” distinct from typical federal boards.

Pressed on why Trump has not attempted to dismiss Powell, Leavitt replied, “It’s a good question — one you can ask the president.”