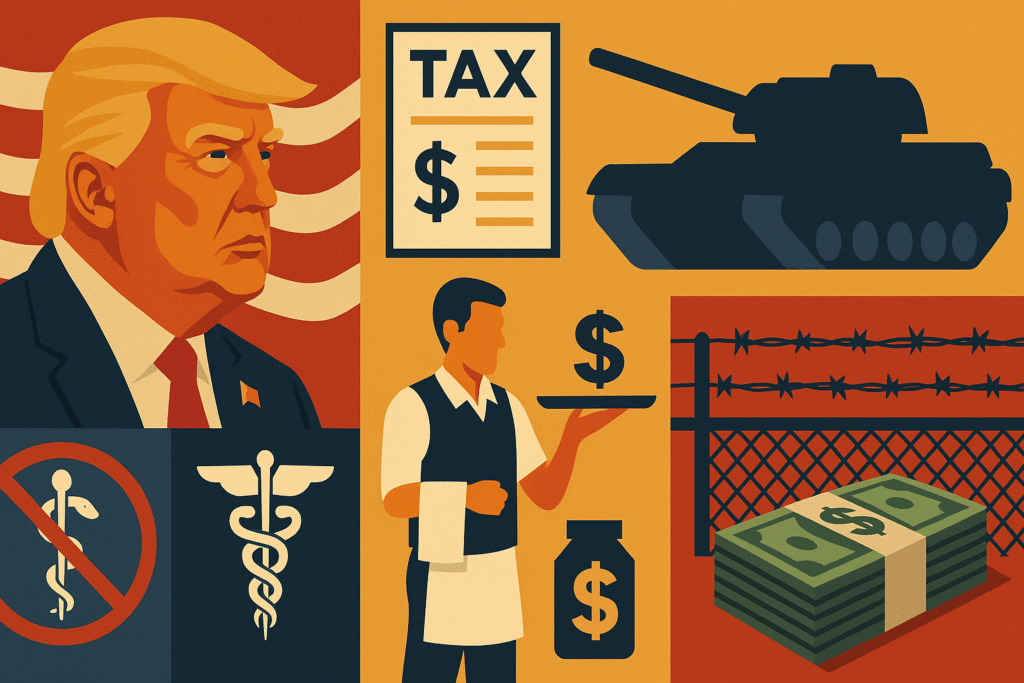

A sweeping 940-page legislative package backed by President Donald Trump is set to undergo debate in the Senate, with potential implications for nearly every corner of American life—from health care and taxes to military spending and immigration enforcement. The bill, a central part of Trump’s second-term agenda, could come to a vote as early as this weekend as Republicans race to pass it before the July 4 deadline.

At its core, the legislation seeks to extend the 2017 Trump-era tax cuts, delivering significant benefits to high-income earners and employers. At the same time, it introduces stricter requirements and deep funding cuts for safety net programs like Medicaid and the Supplemental Nutrition Assistance Program (SNAP).

Key Provisions in the Bill

1. Medicaid and SNAP Reforms

The bill retains controversial new work requirements for Medicaid recipients. Able-bodied adults under 65 would be required to work at least 80 hours per month to qualify, with exemptions for parents of young children and individuals with disabilities. The Senate removed some House-approved provisions—such as bans on coverage for non-citizens and gender-affirming care—after a review by Senate Parliamentarian Elizabeth MacDonough.

SNAP, commonly known as food stamps, would also be restructured. Though an attempt to shift funding burdens to states was initially blocked, revised language now permits states to delay assuming costs. Alaska and Hawaii were granted temporary exemptions if they show “good faith efforts” toward compliance—widely seen as a bid to secure votes from those states’ senators.

2. Extension of Tax Cuts

The bill would permanently extend key parts of the 2017 Tax Cuts and Jobs Act:

- Keeps the top income tax rate at 37% instead of reverting to 39.6%.

- Maintains a 12% tax rate for individuals earning between $9,525 and $38,700.

- Preserves the doubled child tax credit ($2,000) and nearly doubled standard deduction.

According to Sen. Mike Crapo (R-Idaho), the extension would prevent a projected $4 trillion tax hike, allowing families and businesses to plan long-term.

3. No Taxes on Tips and Overtime

A new tax deduction for tipped and overtime income—a centerpiece of Trump’s 2024 campaign—is included. Waiters, hairstylists, and other tipped workers would benefit through 2028, with a $25,000 annual cap. However, those earning over $150,000 individually or $300,000 jointly would see reduced eligibility.

4. National Debt and Spending

Despite concerns from fiscal conservatives, the Senate version would raise the national debt limit by $5 trillion, authorizing payments for previously approved programs. While budget hawks voice concern, the bill spares no expense in defense and immigration enforcement.

Massive Increases in Military and Border Spending

5. Defense Budget: $150 Billion Boost

The bill allocates:

- $9 billion for military personnel benefits, including housing, health care, and education.

- $25 billion for a new “Golden Dome” missile defense system, which Trump claims will be fully operational by 2029.

6. Immigration and Deportation Expansion

The Department of Homeland Security’s budget would double, with $150 billion in new funding. This includes:

- $45 billion for new immigration detention centers.

- $27 billion for a large-scale deportation campaign, including hiring 10,000 new deportation agents—a dramatic increase from the current 6,000.

Trump’s immigration advisor Tom Homan emphasized the need for expanded enforcement to meet the administration’s target of deporting 1 million immigrants this year. “We need more money to do that. We need more agents to do that,” Homan said during a June 26 press conference.

Political Reactions and Outlook

The Trump administration has expressed strong support for the bill, stating that failure to pass it would be a “betrayal” of the president’s promises. Republicans have dubbed it the “big, beautiful bill”, while Democrats have criticized it as a “big, ugly betrayal.”

Sen. Richard Blumenthal (D-Conn.) warned the legislation prioritizes the wealthy while cutting vital services for low-income Americans. Senate Majority Leader John Thune (R-S.D.) is working to secure enough Republican votes, with Trump applying pressure on any potential dissenters.

Conclusion

As debate begins, the bill remains a flashpoint of partisan contention, representing a broad reshaping of U.S. fiscal and social policy. With significant tax relief for higher earners, sweeping social service reforms, and historic increases in defense and immigration spending, the outcome of this legislative effort could define much of the Trump administration’s second term.